What It Means for Everyday Bikers—and What You Can Do About It

There’s something special about life on two wheels. Whether you’re riding a Yamaha YBR125 through Karachi traffic or cruising a Kawasaki Ninja on the highway, motorcycling gives a sense of freedom that cars just can’t compete with. But lately, that freedom has come with a price tag that’s hard to ignore—rising motorcycle insurance costs.

For a lot of riders, it’s no longer just about fuel efficiency or performance. It’s now about affordability and whether that monthly insurance premium is worth the ride. Riders across Pakistan—and around the world—are starting to feel the pinch, and it’s becoming clear that owning a motorcycle isn’t as financially straightforward as it used to be.

So what’s really going on with motorcycle insurance? And more importantly, what can you, as a rider, do to ride smart, stay protected, and keep your costs from spiraling?

Let’s break it down.

Why Motorcycle Insurance Costs Are Shooting Up

Insurance premiums are influenced by several moving parts, and right now, a lot of those parts are working against motorcycle riders. One of the biggest drivers is risk. Insurers calculate the chances of having to pay out for accidents, repairs, or theft—and unfortunately, bikes are considered high-risk vehicles.

Motorcycles don’t have the protective shell that cars do. A minor bump in a car could be a serious injury on a bike. Combine that with the growing number of riders on increasingly busy roads in cities like Lahore and Rawalpindi, and the risk factor just keeps going up. Insurance companies notice—and they adjust their pricing.

But that’s just the beginning.

Repairs are more expensive now too. With newer bikes featuring advanced electronics and safety systems, even a minor crash can lead to a major bill. And let’s not forget the price of replacement parts. Whether it’s a new fairing for your Suzuki GSX or a replacement headlight for your Honda CB150F, the cost of motorcycle parts is rising—and insurance companies are pricing that in.

How It’s Affecting the Average Rider

It’s easy to assume insurance is just one of those “necessary evils.” But when you’re on a tight monthly budget, and you’ve already got fuel, maintenance, and parts costs to worry about, a higher premium can feel like the final straw.

Some riders are making tough choices—downgrading their bikes, reducing their riding days, or even letting go of insurance altogether and hoping for the best. But going uninsured isn’t just risky—it’s potentially devastating. One unexpected incident could wipe out your savings or leave your motorcycle out of commission for months.

For new riders, the situation is even more difficult. Young, inexperienced bikers are automatically charged higher premiums, and in some cases, insurance costs alone make buying a decent bike feel out of reach. This not only slows down bike sales in the country, it stifles the growth of a vibrant riding community.

What Makes a Motorcycle “Expensive” to Insure?

If you’re wondering why your insurance quote seems to go through the roof after checking out a new 400cc sports bike, here’s why:

First off, speed and engine capacity matter. High-performance bikes like the Ninja ZX-6R or Yamaha R6 are seen as more likely to be involved in high-speed accidents. That risk? You guessed it—gets added to your premium.

Then there’s theft. Some bikes are just more attractive to thieves. If your model is known to disappear from parking lots frequently, insurers assume a higher chance they’ll have to reimburse you. It doesn’t matter if your bike is secured—they base it on overall statistics.

Usage matters too. If you ride daily through high-traffic zones in Faisalabad or Islamabad, your odds of a collision are higher than someone who only rides on the weekends.

Even your location can impact costs. Urban areas usually have higher rates due to traffic density, theft rates, and accident statistics.

What Can You Do to Lower Your Motorcycle Insurance Costs?

You can’t control inflation or how insurers calculate risk—but you can control how you ride, how you maintain your bike, and how you approach your policy. Here are a few real-world steps that actually help:

1. Ride Responsibly

This one sounds basic, but it matters more than anything else. A clean record speaks volumes to insurance companies. Avoiding traffic violations, reckless riding, and accidents means you’re proving yourself to be a lower-risk customer.

2. Choose the Right Bike

If you’re in the market for a new motorcycle, think ahead. A 1000cc rocket might sound thrilling, but ask yourself: do you really need that much power for your daily commute? Mid-range bikes like the Honda CB 150F or Suzuki GS 150 offer solid performance without scaring insurers.

3. Keep Your Bike Safe

Installing a reliable anti-theft system or parking your motorcycle in a secure, locked location can help reduce your premium. Insurers like seeing that you’ve taken steps to protect your investment.

4. Bundle Your Policies

If you also have car insurance or home insurance, bundling them with the same provider can earn you significant discounts. Some insurers in Pakistan are finally catching on to this trend, and it’s worth looking into.

5. Compare Before You Commit

Don’t just settle for the first quote you get. Shop around. Get quotes from multiple providers, including local options like TPL Insurance and Jubilee, and compare coverage terms. Sometimes a better deal is just a phone call away.

What Role Does Aliwheels Play in This?

Now, you might be wondering what Aliwheels has to do with rising insurance costs. The answer is simple: everything we do is about helping riders stay on the road smarter, longer, and more affordably.

From supplying high-quality, certified motorcycle parts to offering accessories that improve safety and performance, we make it easier for you to maintain your bike in top condition. And a well-maintained bike? It’s less likely to break down or cause accidents—something insurers definitely factor in.

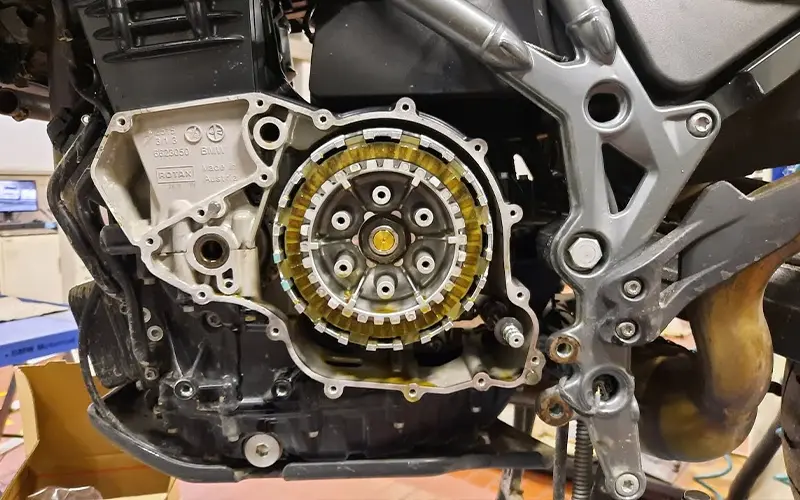

If you’ve ever had to file a claim after a crash, you’ll know how frustrating it is to wait on replacement parts. With Aliwheels, you get access to a wide inventory of radiators, fairings, brake pads, clutch plates, mirrors, headlights, and much more. No delays. No compromises. Just parts that fit and last.

Keeping your motorcycle well-serviced, clean, and protected isn’t just good practice—it’s a long-term strategy for lowering the cost of ownership, including insurance.

What the Future Looks Like

The motorcycle industry in Pakistan is evolving fast. More people are ditching cars for bikes to save time, fuel, and money. With traffic conditions getting worse and fuel prices going up, motorcycling makes more sense than ever. But rising insurance premiums threaten that progress.

It’s time for riders, service providers, and insurers to come together to find solutions that keep riding accessible. Whether it’s safer infrastructure, better insurance education, or partnerships between parts suppliers and insurance companies, change is possible—but it takes effort.

As a rider, your job is to stay informed, ride smart, and make choices that protect your passion. And at Aliwheels, our job is to keep supporting that passion with quality parts, expert service, and real-world guidance—because we’re not just a store. We’re riders too.

Final Word

The rising cost of motorcycle insurance is real, and it’s hitting riders hard. But that doesn’t mean you have to give up what you love. By making smart choices—about your bike, your habits, and how you maintain your machine—you can stay ahead of the curve.

So don’t let a premium dictate your passion. Ride smart. Ride prepared. And when you need parts you can trust, you know where to go.

Shop motorcycle parts now on Aliwheels and keep your bike—and your budget—running strong.